How Liberty Media boosted F1 to commercial success 🚀

Part 1: F1's rebrand and the Drive to US success.

Last November, F1 hosted a grand prix in Las Vegas for the first time since 1982. For many reasons, this showpiece event marked the convergence of the many strands of Liberty Media’s (“Liberty”) strategy for the sport since it agreed to acquire F1 from CVC Capital Partners on 7th September 2016.

Public disaffection with the sport had translated into a drastic fall in fan numbers: in 2016, F1 had 40% fewer TV viewers than eight years earlier. Liberty identified a value opportunity and purchased F1’s equity for $4.4b in 2017, implying an enterprise value of $8b.

According to a Forbes valuation in January 2023, F1’s enterprise value had grown 114% under Liberty’s ownership, to $17.1b. So how has Liberty’s management of F1 since acquisition driven such steep value growth?

This post is the first in a three-part series in which I’ll attempt to answer that question.

Read part 2 here, and part 3 here.

The F1 rebrand

Before Liberty’s purchase in 2017, F1 had no formal marketing, promotion, sponsorship or digital departments. Polls showed a decline in viewership and the sport was considered a technical niche entertainment product.

Bernie Ecclestone, F1’s pioneering and controversial former CEO, tended to rely on expert opinion to dictate his plans for F1’s future. In an immediate shift in strategy, Liberty spent the first few months of its ownership devoted to research into what the public expected from the sport. They discovered that what fans wanted was closer engagement with races and drivers.

Ecclestone had famously shunned social media and once said that F1 did not need to attract a younger audience. Previously, cameras were banned from the paddock for anyone other than broadcasters or F1 itself.

In February 2017, ahead of the Barcelona Grand Prix, Liberty relaxed F1’s social media restrictions, encouraging teams to post clips of drivers and the track. This represented one of Liberty’s first attempts to engage a younger, more diverse audience.

The strategy Liberty has executed, is comparable to that of the NBA, which is much more liberal with its properties than other rights holders.

We analogize our strategy to snacks versus meals. If we provide those snacks to our fans on a free basis, they’re still going to want to eat meals — which are our games. There is no substitute for the live game experience. We believe that greater fan engagement through social media helps drive television ratings.

Adam Silver, NBA Commissioner

Another aspect of Liberty’s strategy has been the use of data to bring fans closer to the racetrack. F1 teams install around 300 sensors in their racecars which produce 1.1 million data points per second. In 2018, F1 partnered with AWS to process this mountain of data and provide strategic insights to enhance the fan experience through broadcast, social and digital media.

Finally, F1 released its proprietary streaming service, F1 TV, in 2018. This product has served two fanbases: (i) avid F1 fans who want more content, and (ii) younger fans who are the most data-comfortable and interactive. The service allows fans to customise their viewing experience, concurrently streaming camera feeds and tapping into the data provided by F1’s AWS partnership.

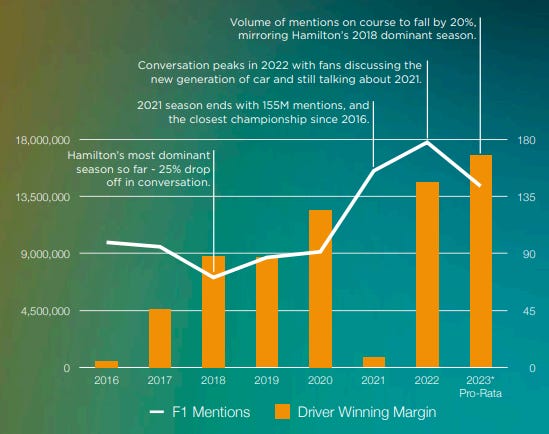

Between 2016 and 2022, online conversations about F1 increased by 80%, a rate bettered only by the IPL and the Champions League among select other competitions. 2016 itself was a highly-spoken-about season, in which Nico Rosberg beat Mercedes teammate Lewis Hamilton to the championship by just five points. Hence, a comparison to another season might show an even more striking increase.

While the increase is not entirely attributable to F1’s digital rebrand, it is at least partly a product of a concerted digital and social strategy to engage a new set of fans.

Unfortunately for F1, analysis of social media trends during the 2023 season show that interest has waned compared to 2021 and 2022. There is a clear correlation in motorsport between competition and engagement: the more competitive a particular season is, the greater the interest from fans.

Despite the Liberty takeover, lockdown and hype around Drive to Survive (“DTS”), there were more social media mentions for F1 in 2016, when Rosberg pipped Hamilton to the title, than any other season until 2021, when Verstappen beat Hamilton in the final race of the season. The hype carried through to the 2022 season but there has been a noticeable drop off this year.

Conversations that imply an increase in boredom or annoyance are on the rise, while positive conversations have declined. Per BuzzRadar, conversations suggesting F1 is “disappointing" were up c.400% in 2023 compared to 2022 while mentions of “exciting” and “fun” are both down c.400%.

It is clear from social media data that the biggest single contributor to this trend is the dominance of Max Verstappen and Red Bull.

The Drive to US success

At a recent speaking engagement, Richard Scudamore, CEO of the Premier League from 1999-2014, said, “if you want eyeballs look East, but if you want dollar bills look West.”

F1’s previous owners had all been European - the private equity firm CVC Capital Partners and Bernie Ecclestone, among others. Undoubtedly, Liberty, a US-based company, recognised that the greatest revenue and value driver for F1 would be to increase the sports popularity in the US. While the previous owners would have been aware of this fact too, Liberty has acted upon it with greater emphasis, and has found success.

Beyond the rebrand, F1’s newly appointed management team were considering other ways to grow the sports audience after Liberty’s takeover. Sean Bratches, F1’s Managing Director of Commercial Operations, suggested a behind-the-scenes documentary to show F1 in a different light and introduce a new set of fans to the sport.

Only F1’s management knows whether DTS was intended to capture the US audience specifically, but what is clear is that the show has achieved that and more.

Nielsen has tracked first-week viewership of each season of DTS, as well as the additional viewership of the prior seasons of the show in the same premiere week to capture viewers catching up or binging for the first time.

Amidst a dearth of live sport broadcasting during the pandemic, F1 was propelled into the cultural zeitgeist thanks to DTS. This fact is not directly captured by the Nielsen data which only tracks first-week viewership as DTS’ second season was released on 28 February 2020 - a few weeks before we were all locked in our houses with nothing but our Netflix subscriptions for company. However, it may be demonstrated indirectly by the subsequent popularity of the season covering the 2020 F1 Championship, despite Lewis Hamilton winning that Championship at a canter.

First-week viewership has increased by 123% since the show’s debut season. This enduring growth is evidence of the production value of the show and its captivating examination of the human condition.

Liberty will have hoped that the burgeoning success of DTS would draw viewers to watch live events, in order to ultimately convert them into revenue generators through a number of avenues. A 2023 survey of US-based F1 fans by Morning Consult provides some evidence of this halo effect. It found that around 2 in 5 DTS viewers started watching races, live or recorded, after watching the show and 22% of F1 fans cited DTS as a “major reason” they started following the sport.

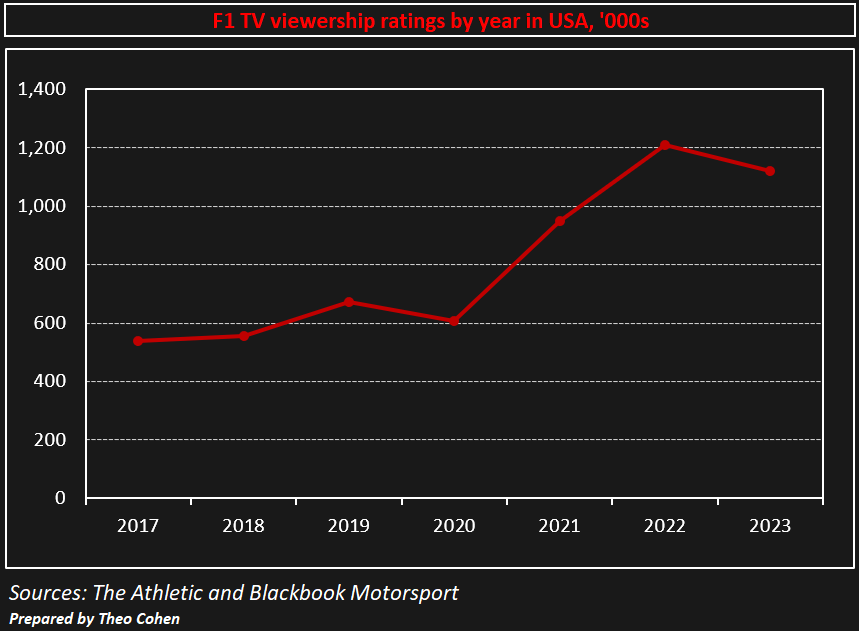

Since the first season of DTS was aired in 2019, US TV viewership averages per race have grown by 67%.

It is impossible to determine exactly how many new viewers DTS has brought to F1 (Nielsen have tried but I’m not convinced by their methodology), especially since its run has coincided with other major developments in F1 including the enthralling 2021 season. However, empirical evidence such as the Morning Consult survey, as well as anecdotal evidence of DTS making new fans of F1 (including myself), attest that the correlation between DTS and viewership growth is not spurious.

The growth in F1 fandom, as well as F1’s growth in the cultural zeitgeist, persuaded Disney (ESPN) to increase their media rights commitment from $5m per year to $85m per year for 2023-2025. This represents a monumental shift from the nadir of the 2018 season when Liberty gave away the rights to ESPN for free after talks with NBC stalled following Liberty’s takeover of F1.

Riding the crest of a wave of US interest in the sport, F1 has introduced two new grand prix in the country: the Miami Grand Prix, introduced in 2022 and the Las Vegas Grand Prix, introduced in 2023. Meanwhile, the 2022 Austin Grand Prix set a new all-time grand prix attendance record. Attracting a crowd of 440k, it became the most-attended 3-day weekend race in F1 history (until the British Grand Prix overtook it with 480k in 2023).

The task ahead for Liberty is to stay on the racing line and not swerve off course. The BuzzRadar study mentioned earlier underlined the importance of a competitive drivers’ championship to sustained fan engagement, and the impact of two years of Red Bull & Verstappen hegemony can already be seen in engagement numbers.

Ahead of the final race of the 2023 season in Abu Dhabi, average US viewership was 1.12 million per race, down from 1.21 million viewers in 2022. In order to return to growth, Liberty will hope that a three-pronged approach to increasing competitive balance can propel the other teams forward toward Red Bull on pole.

This post is the first in a three-part series on Liberty Media’s growth strategy for F1 since its takeover in 2017. Read the second post here, and the third post here.

Please ❤️ this post if you enjoyed it!

Sources

The Athletic;

Autosport.com;

Motorsport;

Joe Pompliano - Huddle Up;

BlackBook Motorsport;

Companies House;

Nielsen;

BuzzRadar;

Forbes;

Formula One;

Fédération Internationale de l'Automobile;

Liberty Media financial statements;

Sportico;

Morning Consult;

Financial Times;

Racefans;

Wieden + Kennedy;

The Guardian.

Throughout this article, I use the terms “Liberty” and “F1 management” interchangeably. Although there is a difference between the two terms, it’s safe to assume that F1’s management and strategy since Liberty’s takeover have been guided and set by Liberty.